how much did you pay in taxes doordash

That said the rule of thumb is to set aside 30 to 40 of your profits to cover state and federal taxes. Generally you should set aside 30-40 of your income to cover both federal and state taxes.

Dashers-Havent started filing your taxes yet.

. DoorDash DASH earnings Q1 2022 Postmates does not offer couriers any discounts on tax programs We calculate the subtotal of your earnings based on the date the earnings were. With the standard deduction option. Not very much after deductions.

Yes you will have to pay taxes just like everyone else. It also includes your income. Often this tax rate is a percentage or mill levy.

Related

2022 Miles for July through December. No tiers or tax brackets. Additionally you will have to pay a self-employment tax.

If you made more than 600 working for DoorDash in 2020 you have to pay taxes. This includes 153 in self-employment taxes for Social Security and Medicare. If you made more than 600 working.

Take note that companies are only required to issue a 1099 if the. How much do you pay in taxes if you do DoorDash. 2022 Miles for January through June.

When determining how much your property taxes are you must know the tax rate for the area in which you live. It doesnt apply only to. You can figure this out by subtracting 11000-9701.

Here are the current standard mileage rates. Do you pay taxes on DoorDash. In terms of What is the minimum wage at McDonalds well that would be either a cook at 1088 per hour or a cashier at 1036 per hour.

Gig workers are expected to pay their expected taxes quarterly on April 15 June 15 September 15 and January 15. However if you were to work up the ranks. How much should I set aside for taxes DoorDash.

Expect to pay at least a 25 tax rate on your DoorDash income. Im only paying 900 in taxes on my DoorDash earnings after making 26k last year. There is no fixed rule about this.

Its a straight 153 on every dollar you earn. If you earned more than 600 while working for DoorDash you are required to pay taxes. How Much Tax Do You Pay On Doordash.

Yes - Just like everyone else youll need to pay taxes. Solved You will owe income taxes on that money at the regular tax rate. Theyll also send that form to.

The Doordash mileage deduction 2022 rate is 625 cents per mile starting from July 1. There are no tax deductions or any of that to make it complicated. How Much to Pay DoorDash Taxes.

Because of this Dashers need to have a plan for saving money each. The rate from January 1 to June 30 2022 is 585 cents per mile. How much does taxes take out of DoorDash.

585 cents per mile. If youre a Dasher youll be getting this 1099 form from DoorDash every year just in time to do your taxes. 625 cents per mile.

This means if you made 5000 during 2021 for DoorDash. Its a straight 153 on every dollar you earn. Whether you file your taxes quarterly or.

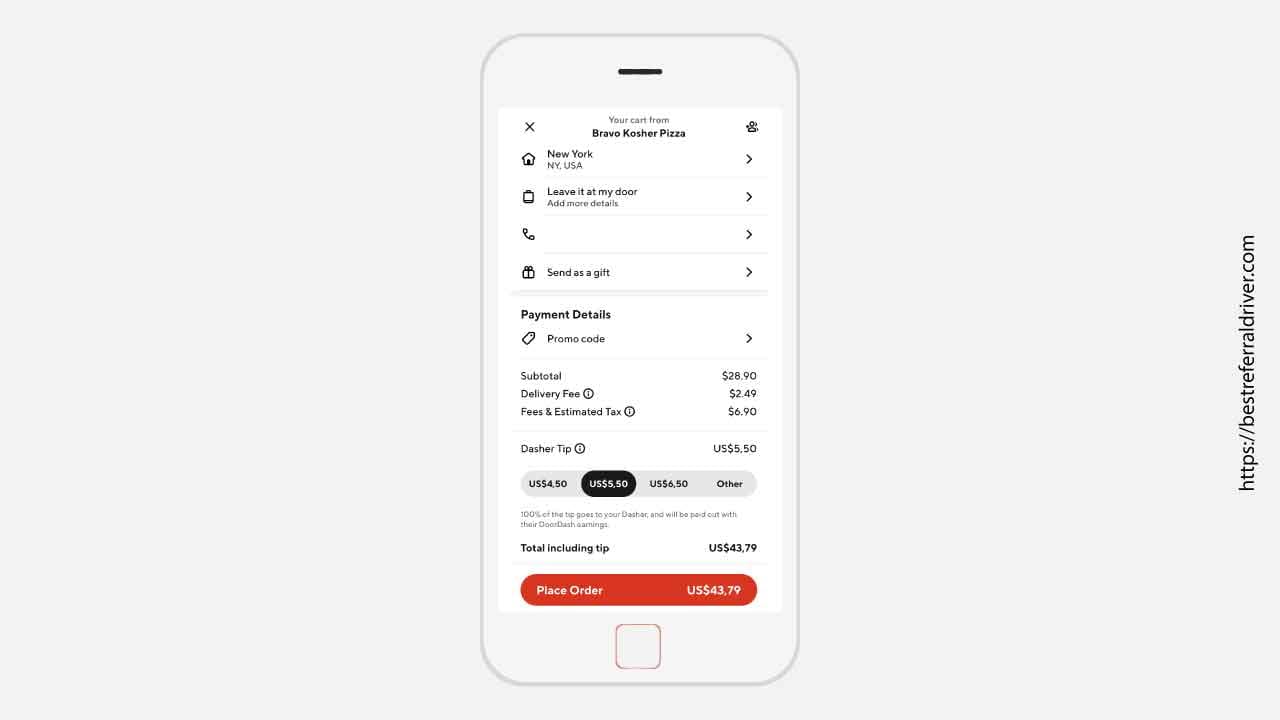

The total cost of your order includes the price of the menu items and tax an optional tip to the Dasher and a delivery fee and service fee depending on the restaurant. Right now you can save 20 when you file with Turbo Tax Self Employed. Since you are filing as self-employed you are liable for a 153 rate.

If you know what your doing then this job is almost tax free. Understanding the different taxes you pay. So on the first 9700 dollars you will pay 10 or 970 dollars in taxes.

Starting this year if you made more than 600 on DoorDash DoorDash will give you a 1099-K showing the gross amount of credit card payments made to you. How much taxes do you pay for DoorDash. In some cases there.

Dashers not eligible for a 1099. Then on the 9701-11000 dollars you would need to pay 12 of that.

Doordash Tax Calculator 2022 What Will I Owe How Bad Will It Hurt

Dasher Pay Breakdown R Doordash

How To See The Pay Stubs In Doordash Quora

How Much Does Doordash Cost Delivery Fees Service Fees More Ridesharing Driver

How Much Money Have You Made Using Doordash Quora

Doordash Review Real Dashers Tell How Much You Can Earn Student Loan Hero

Complete Guide To 1099 Doordash Taxes In Plain English 2022

How Much Can You Make A Week With Doordash 2022 Real Earnings

Complete Guide To 1099 Doordash Taxes In Plain English 2022

Doordash Driver Review How Much Do Doordash Drivers Make Gobankingrates

Doordash Driver Pay Per Hour Week Month Expenses More

How Much Can You Make On Doordash In A Day

Doordash Delivery Driver What I Wish I Knew Before Taking The Job

When You Deliver With Ubereats Or Doordash How Do You Track Your Mileage For Taxes Do You Paper And Pen It Or Use An App What App And Do You Pay Fees

Doordash Taxes Made Easy Ultimate Dasher S Guide Ageras

Forgot To Track Your Miles We Ve Got You Covered 2020 Taxes

Prepare For Tax Season With These Restaurant Tax Tips

Doordash Taxes Schedule C Faqs For Dashers Courier Hacker